The money we make aids us offer you access to cost-free credit rating as well as reports as well as helps us develop our various other excellent devices and also instructional products. Payment might factor right into how and where products show up on our platform (and in what order). Since we typically make money when you find an offer you like as well as get, we try to show you provides we assume are a great suit for you.

Confused about exactly how a cars and truck insurance coverage deductible jobs?, you'll likely come throughout the word "insurance deductible" and also could ask yourself exactly how it influences you and also your insurance coverage prices and also when you'll actually require to utilize it - perks.

Usual vehicle insurance policy deductible amounts are $250, $500 and $1,000. Let's state you skidded into a guardrail, filed an insurance coverage claim that was authorized and also took your automobile to the body buy fixings. Fixings amounted to $5,000, and you have a $500 deductible. The insurance coverage company would offer the body shop $4,500, and also you would certainly have to pay the various other $500 to the store when the repair services were completed - car insurance.

A vehicle insurance policy deductible isn't a solitary quantity that you pay every year prior to solutions are covered, like you'll generally locate with medical insurance deductibles - car insurance. In other words, it depends on where you live. In the majority of states, if you're in an accident that's the other motorist's fault, their obligation insurance policy is usually liable for covering your repair work, approximately the coverage restriction.

The car insurance policy deductible is the quantity of cash you will certainly initially be accountable for prior to the insurance provider starts to cover prices. Unlike medical insurance, vehicle insurance plan deductibles are typically on a per case basis definition you would have to cover these costs every single time you submit an insurance claim.

does not cover the damage you created to other individuals's residential property Covers damages done to your lorry in all instances aside from an accident in which you are at mistake. This consists of points like dropping tree arm or legs, or any type of other kinds of damage that your automobile might incur. How does the deductible job? Your insurance deductible, normally around $750 will be initial applied to any problems.

All About Deductible - Wikipedia

The continuing to be $2,750 would then be covered through the crash coverage by your insurance company (cheaper cars). Sometimes where an additional motorist is at fault for the accident you might wish to submit a third-party case against their Under these conditions your insurer may pursue a process called subrogation to recover the amounts they have actually currently paid.

You can discover more in our post on? Picking the best car insurance coverage deductible amount Your very first factor to consider when selecting your insurance policy deductible is just how much you would certainly have the ability to pay in the occasion of an incident - insurance companies. offer you insurance coverage for an earnings, the even more threat defense you acquire the more they profit and also the reduced your deductible the more danger protection you are getting.

It is also vital to bear in mind that since vehicle insurance coverage deductibles are on a per-claim basis so the regularity of your claims will certainly be among the most important aspects. If your plan has a $500 insurance deductible and also you were associated with four different cases of much less than $500, then you would be in charge of 100% of all the settlements and your insurance coverage would have offered no coverage.

One technique you can take is to consider your driving as well as lorry history. If your background indicates that you might need to make even more frequent insurance claims, you may want to take into consideration choosing a policy with lower expense costs. On the other hand, if you have not had a history of accidents you might not require a reduced insurance deductible strategy. low cost.

If you've got vehicle insurance policy or are looking around for some you might have heard the term "insurance deductible." When you build an automobile insurance coverage, you'll need to decide just how much of a deductible you desire, most typically either $500 or $1,000. What precisely is an auto insurance coverage deductible? As well as just how much should yours be? We'll aid you understand your deductible and what's finest for your auto insurance policy to aid safeguard what matters most.

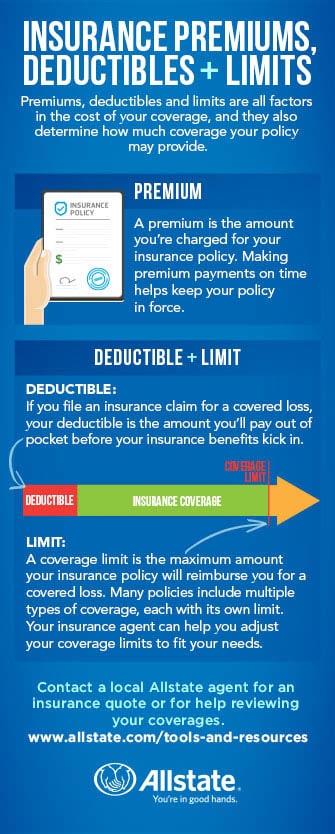

Insurance deductible So what's the distinction in between your insurance policy costs and your insurance deductible? The costs is what you pay per month, every 6 months or every year depending on your policy's payment strategy to preserve your insurance coverage policy (cheaper auto insurance).

The Single Strategy To Use For Car Insurance Deductibles: How Do They Work? - Website link The Motley ...

This is because you're essentially paying to have fewer out-of-pocket costs must you sue, so your future insurance claims payments may cost the insurance provider more than a person with a higher insurance deductible (prices). On the various other hand, the greater your insurance deductible, the lower your premium will be. Ordinary Automobile Insurance Coverage Deductible The ordinary cars and truck insurance coverage deductible is $500, which, if a case is filed, will generally be much less than whatever the expense of repair services are for a major accident.

With a $500 deductible, you would just pay $500 in the direction of the fixings, while your insurance policy firm would certainly pay the remainder. Is it far better to have a $500 deductible or a $1,000 deductible?

A cars and truck insurance policy deductible is the quantity you're responsible for paying out of pocket. Whether you need to pay a deductible depends on the kind of insurance claim you file and also that (if anybody) is at fault.

/Understanding-What-is-a-Deductible-in-Insurance-Women-Explaining-58900c523df78caebc6ea56b.jpg) auto auto insurance vehicle insurance accident

auto auto insurance vehicle insurance accident

The insurance policy company will only pay for expenses that exceed $1,000. Deductibles usually vary from $100 to $2,500 (auto). If you have even more than one kind of insurance coverage with an insurance deductible, you can choose various insurance deductible quantities for each protection type.

cheapest car insurance cheap auto insurance vehicle insurance insure

cheapest car insurance cheap auto insurance vehicle insurance insure

If you can not manage to pay your deductible, you won't be able to cover all the repair work. The insurance policy business will just pay for costs that surpass your deductible.

/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg) car insurance vehicle insurance vehicle insurance risks

car insurance vehicle insurance vehicle insurance risks

If you believe it's unlikely you'll need to sue, you might consider a higher insurance deductible. No issue what amount you pick, it is necessary to make certain you can manage to pay it if you need to file an insurance claim complying with a mishap. Deductibles put on some sorts of auto insurance protection yet not to others. affordable auto insurance.

How What Is A Car Insurance Deductible? - Credit Karma can Save You Time, Stress, and Money.

cheapest car insurance low-cost auto insurance cheapest cheap

cheapest car insurance low-cost auto insurance cheapest cheap

This kind of coverage helps spend for repair service as well as replacement prices if you remain in an accident. Covers incidents that run out your control and also don't involve a collision, such as extreme weather, rodent damage, dropping things, theft, as well as criminal damage - cheap auto insurance. Assists spend for vehicle fixings if the at-fault motorist doesn't have insurance coverage or doesn't have adequate insurance coverage to cover the cost of the repair work.

This kind of protection is not available in all states. If an insured motorist hits you, you do not require to pay a deductible because the other driver's insurance coverage will certainly cover the damage. If you ever require to file a case with your insurance policy company, you will certainly be responsible for paying the insurance deductible.

Insurance policy suppliers make use of deductibles to aid minimize their threat involving you, the insured party. What Is a Car Insurance Policy Deductible?

Not all auto insurance policy protection requires an insurance deductible, but you will generally locate a deductible is needed for the list below types of insurance coverage, according to Progressive: Comprehensive, Crash, Accident defense, Uninsured/underinsured driver, The deductible will certainly work the exact same way despite the insurance coverage kind and will certainly be required any time you make an insurance claim.

You may likewise have to pay your insurance deductible if your windscreen is damaged, although some insurance policy firms do offer full glass insurance coverage as a choice. Are There Times When No Insurance Deductible Is Needed?

Also though you caused the crash, you don't have to pay anything out of pocket when a person makes an insurance claim versus your responsibility insurance for problems you trigger to their residential property or for injuries. Other scenarios where you will not be required to pay a deductible consist of: An insured driver strikes you.

Understanding Your Auto Insurance Deductible for Dummies

You choose cost-free repairs on your glass - cheap car insurance. Being associated with a crash with another guaranteed chauffeur, where the accident is deemed their mistake, implies you won't need to pay a deductible because you'll be making a case through their obligation insurance policy. You do have the option to make an insurance claim via your own accident insurance coverage, if you have it.

When consulting Allstate, we discovered that, depending on the state you live in and also the insurance service provider you make use of, there is a zero-deductible alternative available. Naturally, picking a zero-deductible alternative on your insurance coverage plan will likely cause a greater monthly premium. This is due to the fact that all the danger is now assumed by the insurer.

The finest amount for you will depend on your financial scenario because your insurance deductible affects your monthly costs rate. Dynamic suggests that you maintain this in mind when deciding what total up to establish for your deductible: A greater insurance deductible suggests a reduced monthly costs, yet a higher out-of-pocket cost when making a case.

Knowing what your car insurance policy deductible is and also when you have to pay it is a vital facet of deciding what kind of insurance coverage you desire. Make certain you'll have the ability to cover the deductible quantity when you make a case to your insurance coverage company to stay clear of any kind of issues with obtaining repair services taken treatment of in a timely way.

For any type of feedback or adjustment requests please call us at. Resources: This web content is created and also maintained by a 3rd party, and imported onto this page to help customers provide their email addresses. car insured. You may be able to discover even more information about this and similar material at.

What is a vehicle insurance deductible? The deductible is the dollar amount "subtracted" from an insured loss - insurance company. Simply put, the insurance deductible is the quantity that a person should pay out of pocket for repairs or replacement after a crash. As an example: allow's say you remain in a minor car accident, the overall price of repairs is $1,000, as well as your insurer pays $800.

Not known Facts About Car Insurance Deductibles Guide: 5 Key Things To Know In 2022

1 For several customers, establishing simply how much of a deductible to take can be a challenging choice. How does an automobile insurance deductible job? Traditional car insurance plan generally require the customer to pick one insurance deductible for extensive protection, as well as a different insurance deductible for collision protection, although they might coincide insurance deductible amount.

Comprehensive protection secures your car from burglary and damage not brought on by a collision. The insurance deductible on your policy will apply if you submit a case for damage covered by extensive, however there are some circumstances in which you do not have to pay an extensive insurance deductible. For example, fractures or contribute your windscreen might be paid completely by your insurance provider depending on the state you stay in. insurance.